Services

No single strategy fits every situation, which is why every client receives our undivided attention—from initial analysis of financial needs, to recommendation, implementation, and consistent reevaluation.

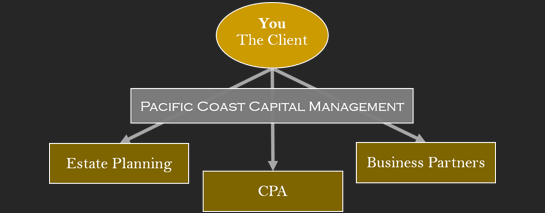

Over the years, we have developed an effective team approach to help clients who have a wide variety of needs as they maneuver through a complex financial-services world. We strive to understand your entire financial situation and provide you with high quality information, services, and investments. No single strategy fits every situation, which is why every client receives our undivided attention—from initial analysis of financial needs, to recommendation, implementation, and consistent reevaluation.

Our services include:

- Wealth planning

- Investment and risk management

- Retirement preparation and forecasting, including executive compensation examination (including stock option management and deferred compensation)

- Tax efficiency

- Estate planning and multi-generational transfer

- Life insurance needs analysis

We collaborate with your estate attorney, CPA and additional business partners to work towards providing objective investment solutions that encompass your complete financial landscape.

FINANCIAL PLANNING

Modeling and Projections

Selling a Business

Financial Wellness

Cash Flow

Goals and Priorities

Time Horizon

INVESTING/RISK MANAGEMENT

Portfolio Management

Asset Allocation and Diversification

Portfolio Income

Risk Tolerance Shifts

Liquidity Needs

RETIREMENT PREPARATION

Retirement Scenarios

Social Security

Lifestyle Goals

Income Projections

ESTATE PLANNING

Wealth Transfer

Charitable Vehicles

Gifting strategies

Legacy Goals

Trust Funding

Continuity for Family

TAXES

Tax Efficiency Strategies

Tax Liability Minimization

Changes to Tax Laws

Tax Exempt Income

Tax Deferred vs Tax Exempt

INSURANCE

Review Insurance Coverage

Policy Development

Benefits

Income Protection Strategies

Term and Whole Life

Needs Analysis